If we want an energy transition, we must have more mining

By Mads Qvist Frederiksen, Executive Director of the Arctic Economic Council.

The demand for raw materials is expected to increase by 500% between now and 2050, according to the World Bank, due to the energy transition that the world is going through.

There was a watershed moment in history when the earth was first “turned inside out” and humans started to exploit the raw materials that make up the primordial foundation of our planet. Today we once again look underground for the solutions to our challenges.

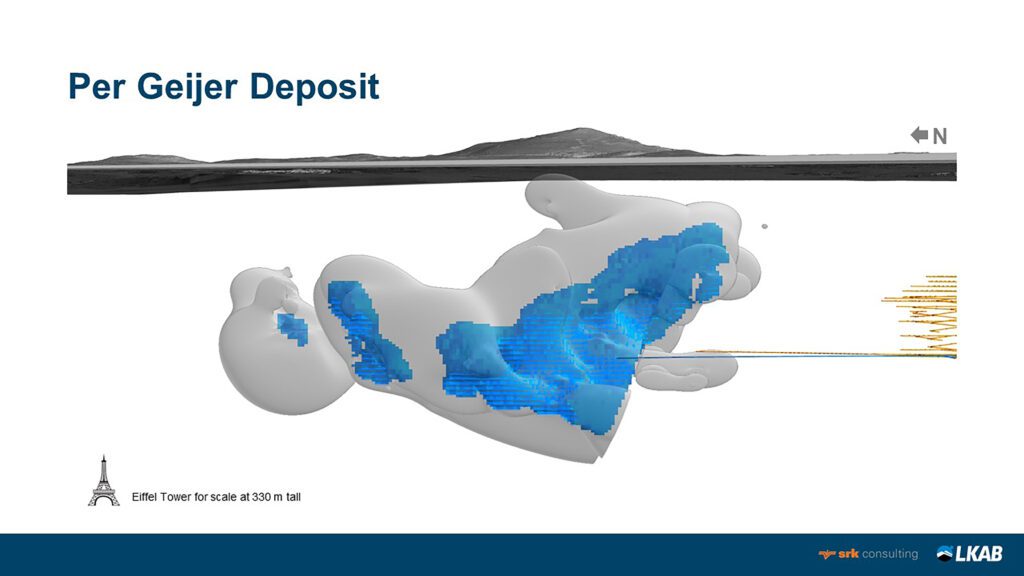

In the Arctic region, we can find many of the metals and minerals needed for the green transition. On January 12th 2023, the Swedish mining company LKAB announced that around 700 meters below the ground, they had discovered the largest known deposit of rare earth elements in Europe – a raw material that is it is critical for our transition to new, green technologies but is not currently being mined in Europe.

All across the Arctic, the local communities have for centuries been involved in the mining sector. The region has been mined throughout history to attain the building blocks for a more modern and developed civilisation globally. Yet, people’s understanding of the importance of mining has decreased over time as new mines have been placed in remote and distant locations with different regulatory frameworks than in the Arctic. However, now the world needs Arctic mining again because the region has many of the raw materials needed in the green transition and in places with fair and transparent jurisdictions.

Politicians are awaking to the need of mining for a clean and greener future

In early March 2023, the European Union (EU) published their new Critical Raw Materials (CRM) Act. It may not have made a lot of headlines around the world, but it is important for industries, remote Arctic communities, and the wider population.

The president of the European Commission Ursula de Leyden highlighted the importance of mining at the beginning of the year when she said:

“The economies of the future will no longer rely on oil and coal, but on lithium for batteries; on silicon metal for chips; on rare earth permanent magnets for electric vehicles and wind turbines. And it is sure: the green and digital transitions will massively increase our need for these materials.”

Some analysts even argue that the opening of the first EU office in Nuuk, Greenland is related to Europe waking up to its need for new sources of raw materials.

Simultaneously in the US, President Biden earlier announced an increase in the development of green technologies. The new Inflation Reduction Act (IRA) also includes large tax breaks for mining companies that can produce the required critical raw materials. Last year, the US also launched a $30 million initiative to research and secure the supply chain of domestic raw materials.

Both the EU and the USA have recognised that they risk simply replacing fossil fuel dependency to mineral dependency from authoritarian states if they don’t act now.

China – who today is processing most of the world’s raw materials and thus holds a competitive advantage, is also moving into new mining regions such as Madagascar and deep-sea mining off the coast of Mozambique. Some Chinese companies have also shown an interest in mining projects throughout the Arctic region.

Mining has become an issue of security but it is also just as much about the future of planetary health; the unavoidable fact is that our sustainable future begins deep underground in a mine. Yet, there were no references to mining in the most recent report of the International Panel on Climate Change (IPCC).

We cannot afford to slow down with mining. It is clear that we are going to need a vast amount of green energy in the future, and for that, we will need a vast amount of critical minerals.

In the coming two decades, we will require a 500% increase in the production of lithium and graphite in order to meet demand. Some people estimate that our activity will necessitate the opening of more than 330 new mines in the near future, and with one mine normally taking more than 15 years to become operational, we have no time to waste.

We need to invest more in new mining projects

Today’s mineral supply and investment plans fall short of what is needed to transform our energy sector. A growing and more resource-hungry population means larger quantities of CO2 emissions unless we are able to change our basic technologies.

If you want to build a battery to store energy, you need lithium, nickel, cobalt, manganese, and graphite to ensure high performance, longevity and, energy density.

If you want to expand your electricity network, you need copper and aluminium.

If you want to build permanent magnets that are used in wind turbines and electric vehicles, you need rare earth elements.

In 2019, Finnish geologist Simon Michaux estimated that the world has to increase the production of several raw materials several times, above all total historical production to date, to reach our climate ambitions. Therefore recycling will not take us all the way.

A typical electric car requires six times more mineral inputs than a conventional car, and an onshore wind turbine requires nine times more minerals than a gas-fired plant of the same capacity. Since 2010, the average amount of minerals required for a new unit of power generation capacity has increased by 50%.

It is also the critical raw materials which we need in our satellites, computers, and connectivity infrastructure. The defence industry also needs the minerals that we are currently sourcing from authoritarian states. Each F-35 jet contains more than 400 kilos of yttrium, terbium, and other rare earth elements. Nuclear reactors and lasers use samarium, missile guidance systems need neodymium, night vision goggles need lanthanum, etc. In the autumn of 2022, the Pentagon temporarily halted deliveries of F-35 jets after discovering that the raw materials used for a magnet had been made with a cobalt and samarium alloy from China. As such, they had to find a place closer to home in their supply chain. Today, the majority of rare earth mining, refining, and processing takes place in China.

In 2010, China and Japan entered a trade dispute when the former suddenly halted all shipments of rare earth elements to Japan. The dispute began when the Chinese government reduced its export quotas by 40% which resulted in import prices rising quickly. China argued that this decision was made to protect the environment, but the West called it protectionism in disguise. The dispute was later resolved in the WTO, but it caused western governments to begin looking outside of China for rare earth elements.

For the climate, for security, and for jobs

As we can see, we must diversify our raw materials supply and develop mining operations in new places, instead of outsourcing to developing countries. The Arctic region contains many of the minerals that are currently mined elsewhere, even though the quality of the ore could possibly be better in the north.

We cannot get anywhere close to the quantity of required raw materials in a sustainable manner unless developed countries are also pursuing mining opportunities.

The good news is that there is growing consumer demand for more supply chain transparency, tighter environmental regulations, and labour rights. This, combined with the strategic importance, may lead to more mining in the Arctic. The first obstacle to overcome is the idea of “NIMBY – not in my backyard” or “Green colonialism” which some interest groups are promoting. Some of the interest groups don’t even live in the front yard of the Arctic but believe that the region should be kept separate from wider global development.

I believe that when presented with the options of where and how mining takes place today, and how it could take place in the Arctic, this information could bring more people together. Local communities ultimately benefit from having a mine close-by. They create new jobs and the supply and demand for supporting services. In some parts of the Arctic, it is the mining companies that construct and develop the infrastructure to improve the lives in the north. For example, through investment in schools and renewable energy.

It was the demand for metal that drove industrialization from approximately 1700 to 1900, followed by the demand of new infrastructure and two world wars which led to the development of modern materials. Subsequently, the growth of big science and high-tech, combined with the rise of China from early 2000 has resulted in not only an exponential increase in energy demand but also in the demand for minerals.

The production of copper, zinc and steel has escalated drastically in the past 50 years. By 2030, the 20 million project EV charging points, that are anticipated globally, will consume 250% more copper than produced today. Wood Mackenzie estimated in 2022 that 9.7 million tonnes (Mt) of new copper supply is needed over 10 years from projects yet to be sanctioned, equivalent to nearly a third of current refined consumption, if industry is to meet the Paris Climate Agreement targets. They also estimate that more than US$23 billion a year will be called for over 30 years, to deliver new projects under an accelerated energy transition scenario.

According to World Bank study from 2017, we need to increase our production of nickel by 100%, indium by more than 200%, and cobalt, lithium and graphite by more than 450% no later than 2050 in order to reach our climate targets.

The challenge is now that we have mined our way through history, so the quality – or the grade – of the minerals is getting worse at the surface. We must dig deeper to retrieve useful material. We must also use new and innovative methods to find “hidden” or “blind” deposits.

Another challenge we face is that 50 years we did not mine for many of these critical minerals and as such some rocks containing key materials were not processed correctly and ended up in tailings piles. Consequently, our understanding of, and current mining practices around these metals, is poor in comparison to others. Therefore we need to increase exploration for these critical raw materials. This is where the Arctic region can come in to help.

The Arctic got the opportunities to be a prime area for mining

The solution to the supply problem is relatively straightforward. We can either mine more, recycle better, or massively reduce our consumption. The main challenge with the latter solution is that many of the elements used in modern devices were not used in older products. And that the amounts we need are greater than historically mined. For just copper, we use four times more of it in an electric car than in an internal combustion engine.

Therefore, we need to mine.

There is a saying, when is the right time to plant a tree? The answer is yesterday, but when is the second-best time? And the answer is today. The same goes for mining. We should have started to invest a long time ago but we can still make it if we start today.

First the good news, we don’t lack the raw materials. In fact, for example, the so-called rare earth elements are not very rare at all. What we lack is robust finance for mining, quicker permitting, and customers who are willing to pay a premium for more responsible mining.

While mining activities have been undertaken for thousands of years, the mining industry in the Arctic is moving towards maximum benefits with minimum impact. Whilst mining by its nature is not sustainable, it can be responsible. The latest technologies in mining can help to mitigate and minimize environmental and societal impacts.

Some of the main obstacles facing mining are the absolutist anti-mining positions taken by some interest groups and well-meaning forces in the developed world. However, these harsh line policies can often result in the opposite outcome in regard to biodiversity and global impact. As without support we instead experience a “mining leakage” where the projects don’t disappear but are instead shifted to faraway places. Mines are shifted from nations with benign practices, strict human rights, and environmental regulations to regions with less stringent social and environmental policies.

Large investments in mining in the Nordics

In the north of Sweden, within the Arctic Circle, you find the unique town of Kiruna. The town of around 20,000 people only exists because of the iron ore mine which has been in operation for more than 130 years by the state-owned mining company LKAB. Today LKAB produces approximately 80% of the iron ore in Europe and has the potential to be the leading producer of REE and phosphorus in the EU.The mine is constantly under development and expansion, with the company having paid millions for the construction of a new part of the city, and the relocation for some inhabitants due to the expanding operation. LKAB has, together with the Swedish mining industry, committed to a biodiversity strategy pledging that by 2030, the minerals industry will contribute to a biodiversity net gain in all regions where mining takes place.

LKAB has also made the largest private investment in the history of Sweden to reduce their CO2 footprint – worth more than 1 billion euros year for a 20-year period. Through investments in R&D and renewable energy, they are aiming to produce fossil-free hydrogen-powered steel in partnership with SSAB and Vattenfall. This technology will potentially cut 40-50 million tons of CO2 emissions annually from Europe’s iron and steel value chain. This is equal to Sweden’s entire annual CO2 emissions.

A by-product from the mining production of REEs in Kiruna is phosphate, which can be used for fertilizers and has become particularly important for food security following import disruptions from Russia. Another by-product is gypsum, which can be used to make concrete less CO2 intensive.

The county of Kiruna is also home to other mines that produce copper, silver, gold, zinc, lead, vanadium, titanium, phosphorus, and pyrite. Combined with abundant renewable energy via hydropower and vast open spaces, many companies are looking to the north as a part of the green transition. That is why companies such as the battery company Northvolt decided to locate their first European factory in Northern Sweden, and why some parts of Northern Sweden now are seeing housing prices tripling as communities are estimated to double in the coming years.

In Norway, mining has been a cornerstone in the development of places such as Kirkenes on the border to Russia or on Svalbard close to the north pole. Today, the company Nussir, that is mining copper in northern Norway, aims to become the world’s first fully electrified mine.

In Northern Finland, you will find the largest gold mine in Europe operated by the Canadian company Agnico Eagle. This is also the location of many other resources, including copper, nickel, and cobalt. Finland is, according to Frasier Institute, the most attractive country in the EU for global mining and sits third in Europe in the Battery Supply Chain Ranking from Bloomberg.

From Klondike to Red Dog

In North America, the famous Klondike Gold Rush and today, companies like Agnico Eagle are operating two gold mines in the Arctic part of Canada and are working actively to build schools and infrastructures to support the communities. In Alaska, the world’s largest zinc mine, Red Dog, is located 170 kilometres north of the Arctic Circle. In 1989, the Red Dog mine was developed through an innovative operating agreement between the operator Teck and the land owner NANA, a regional Alaska Native corporation owned by the Iñupiat people of northwest Alaska.

Greenland developed as a mining country when cryolite was used in aluminium production and later a coal mine opened in Qullissat, which became a centre for the industrial development of the country. Already in 1848, the Danish explorer H.J. Rink explored for graphite in Greenland. Today, only two small-scale mines are in operation, one of them for rubies just south of the capital Nuuk. Yet, the world’s largest island still holds nickel, cobalt, copper, titanium, molybdenum, and REE.

The diversity of raw materials

We constantly surround ourselves with products and materials that at some point has been sourced from some rock, somewhere on the planet, yet the general public’s understanding of minerals, metals, and raw materials are limited. Both the usage of the elements in the periodic table as well as the business model.

Defining critical materials

The term critical raw materials (CRM) is often used by governments or organisations to define important imports. A mine is locked to a geographic location, so these CRM lists can vary from country to country depending on their industries and their import.

Since 2011, the EU has released five CRM lists. These state specifically what raw materials have a high importance to the EU economy and of the high risk associated with their supply. The list has grown over the years from 14, to 20, to 27, and in 2020 to 30 raw materials out of 66 assessed on their economic importance and supply risk. In addition, in many cases the materials have low or no substitutes with a low recycling rate.

The supply of many critical raw materials is highly concentrated. For example, China provides 98 % of the EU’s supply of rare earth elements (REE), Turkey provides 98% of the EU’s supply of borate, and South Africa provides 71% of the EU’s needs for platinum and an even higher share of the platinum group metals iridium, rhodium, and ruthenium. The EU relies on single EU companies for its supply of hafnium and strontium.

Some raw materials come into the market through its main products like lithium, some are byproducts like cobalt, and some are not products before they have been at the smelters or refinery, like Iridium, Ruthenium and Osmium. So, to increase those, we must increase the accumulation of source products where they originate from. In other words, there is no such thing as a cobalt mine – today 98% is mined as a byproduct of for example a copper or nickle mine. Which makes it more difficult to mine as the economics don’t always add up, when you are looking for extremely small concentrations.

“Neither-rare-nor-earth” elements

The most hyped raw materials among policy makers are “Rare earth elements” (REE) that are neither rare nor earth. They are however the 17 elements that are vital in energy production. In petroleum refining but more importantly in magnets. They are called rare as they are difficult to find in a pure form, but they are located around the world – also across the Arctic region. One of them, cerium, is the 25th most common element on the planet. The term ‘earth’ comes froman archaic term for something that can dissolve in acid.

Raw materials supply chains

When the Cold War ended a series of US and EU policy decisions resulted in China nearly monopolizing REE production and refinement. The EU today imports 98% and the US 78% of its REE from China.

China is not a natural REE country despite having some deposits in Xinjiang and Inner Mongolia, they have instead invested their way into REE projects around the world and developed the processing industry that many in Europe considered ‘too dirty’ to have in their backyard. Today, China accounts for 87% of the world’s REE reserves, 60% of its mining and capacity, and most importantly over 90% of its refining capacity according to IEA.

The US has been especially focused on closing the production gap with China in recent years. New process and separation facilities have been constructed in Australia and Texas. The new found deposit in northern Sweden will not secure complete independence but will be a step on the way. However, LKAB has said that it will take 10 to 15 years before any REE from their mine will be on the market. Furthermore, that is if the permitting goes smooth and REE processing capabilities are developed in Europe. A processing system that is both technically difficult and comes with environmental challenges. China still produces 92% of the REE magnets in the world, so Europe would need to step up its efforts to insource the production and build up new know-how.

Challenges to mining

These efforts from countries to diversify their supply chains to secure strategic autonomy and make them more resilient also come with a cost. Not only of duplication and inefficiency but also at higher costs and a production that is vulnerable to shocks. Development challenges: from discovery to production

For a mine to go into production it needs some relevant rock, the technical skills to extract it, loads of finance at various stages, and a license to operate from the local community and government.

A main challenge in mining is the long project development lead times. Some analysis estimates that it takes 16.5 years on average to move from discovery to the first production.

A second challenge is the financing model. A mining project normally starts with some non-profitable exploration done by a prospector, then a junior will come in, before a developer makes it more large-scale, and then it finishes with the closure of the mine. Financially, most of the money is made during the extraction phase. However, the prices of raw materials are extremely volatile and so that we expect investors to invest while prices go down.

Third, today we are good at resource conversion and expansion, but more importantly, the grade or quality of the raw material is going down. We are simply moving more rocks for less metal. As an example, in an open pit copper mine, you need to move 1 ton of soil to extract 10g of copper. In recent years, ore quality has continued to fall across a range of commodities in the large, high-grade deposits found near the surface. For example, the average copper ore grade in Chile declined by 30% over the past 15 years. Extracting metal content from lower-grade ores requires more energy, exerting upward pressure on production costs, greenhouse gas emissions, and waste volumes.

A fourth challenge is, jurisdictional restrictions, community relations, access to land, competition with other industries over land, access to energy and water, environmental and biodiversity rights etc.

The Arctic is leading our way through the green transition

Location, location, location is the most important characteristic when buying a house or developing a mine. For the mine you first need the location with the right rock, you need space to excavate and develop the project, and you ideally would like access to port infrastructures, renewable energy, and plenty of water. You also want to be close to the main market and be able to recruit a qualified workforce. Then you want stable, predictable, and long-term framework conditions, and a transparent political system.

In the US, there is talks about “friend-shoring”, where countries rely on allies for the sourcing of raw materials rather than authoritarian regimes. The minerals needed in the green transition are more concentrated than oil and gas. For lithium, cobalt and REE, the world’s top three producing nations sit on ¾ of the global output. The Democratic Republic of Congo (DRC) is responsible for around 70% of global production of cobalt; and more than half of the refining of cobalt happens in China.

We have cobalt in locations around the Arctic region. The question is if policymakers are ready to have more mining in the north or continue to have it in the DRC with slave labour, with the policy regulation of China, and the instability of Myanmar.

Public support

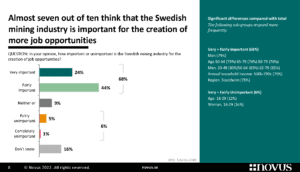

The good news is that the Swedes, for example are ready for more mining. In a survey from early 2023, six out of ten people between the ages of 18 and 79 believe that the Swedish mining industry should be given the opportunity to develop in order to secure the supply of important metals. Even more, half of the respondents could see themselves accepting an active mine in their vicinity. More than 70% believe that the mining industry is important to the Swedish economy and 68% think that the sector is important for job creation. In Sweden, the population understand that everyone must give up something for the greater good of our planetary health. This is reflected in a track record of robust environmental legislation.

Some trends in the manufacturing sector also drive the opportunities in the Arctic. The need for full transparency of the supply chain, from mine to product, and the increased attention on sustainability means that Arctic mines might be able to charge a “green premium” in the future for their product. Today, sustainability provides a competitive advantage in some places, but tomorrow sustainability will be the license to operate.

Sustainability, supply chain resilience, and recycling will be increasingly important.

Best resource management practices are in the Arctic

The Arctic region has always been resource-rich, regarding energy, raw materials, and fish. For centuries these were the three pillars of the local economy in the region.

The mining industry could learn a lot from the management of the Arctic fishery, where political and constituent support has been essential. For the High North Arctic Sea fisheries, there has been a broad coalition of scientists, companies, politicians, and indigenous groups working together to shape what action was necessary due to the changing conditions. But it does not come for free.

Therefore, the Arctic region needs adequate investments into mining projects that can help with diversification of the supply chain. The talks from policymakers about green transition needs to be followed up with action within mining.

The first step for a more developed mining sector in the Arctic is through exploration. Policymakers can support and enhance the possibilities to undertake exploration work to gain knowledge and collect geological data to find new raw materials. Here a close partnership with researchers is crucial as well.

Secondly, if we start to think “raw materials first” in legislation and policy, then we create a higher awareness of the importance of raw materials from supply to domestic production. We also need to acknowledge that the speed and quality of permitting conditions can be improved. That could happen through a fast-track permitting, allocating specific mining projects as strategic, and making sure that the opposing interests don’t slow down the permitting process. This could be combined with requirements on offsetting and of creating biodiversity net gain.

Third, we must broaden the scope of critical and strategic metals in policy. If the trend continues, then the CRM lists will just grow in the coming years. It is important that policymakers understand that many of the CRMs are linked to so-called carrier metals such as iron, copper, zinc and, other common mined metals.

We must also call for more transparency in mining supply chains whilst also ensuring the resilience of them. This will help companies to make sourcing of raw materials easier while also pushing for mainstreaming higher ESG standards. Furthermore, companies must continue their R&D in new technologies and look at material substitution and ease recycling.

The raw materials in the rocks cannot be relocated. They inevitably must be mined where they are located. This means that mining concessions and environmental permits for mining always ends up in conflict with other land use or nature protection interest.

According to the European Raw Material Alliance, more than 1,2 million jobs would be needed to fulfil the potential within the raw and advanced material sector by 2030. In a region with just four million people in total, we know that we need to attract more people to come and work.

The Arctic offers the raw materials we need to build a greener and cleaner future, but it would take some policy changes and local compromises to fully utilize the potential. I believe though, that if we manage to show the opportunities in the north – then people will come and make a difference for the global community.